Zoning maps are vital tools for real estate investors, providing critical insights into land use regulations, property values, and market trends. By analyzing these maps, investors can identify development opportunities, anticipate urban shifts, stay ahead of regulatory changes, and make informed decisions to maximize returns while navigating legal restrictions. Integrating zoning map data with financial analysis offers a strategic advantage in today's dynamic real estate landscape.

Zoning maps play a pivotal role in shaping urban landscapes and investor strategies. As cities evolve, understanding the interplay between these regulatory tools and financial trends is crucial for making informed decisions. This article delves into the comparative analysis of zoning maps as a strategic compass for investors, offering insights on how their nuanced understanding can optimize resource allocation and mitigate risks. By exploring various scenarios, we’ll unveil the power of zoning in navigating financial trends, providing valuable guidance for seasoned investors and those new to the dynamic world of urban real estate.

Understanding Zoning Maps: A Key for Investors

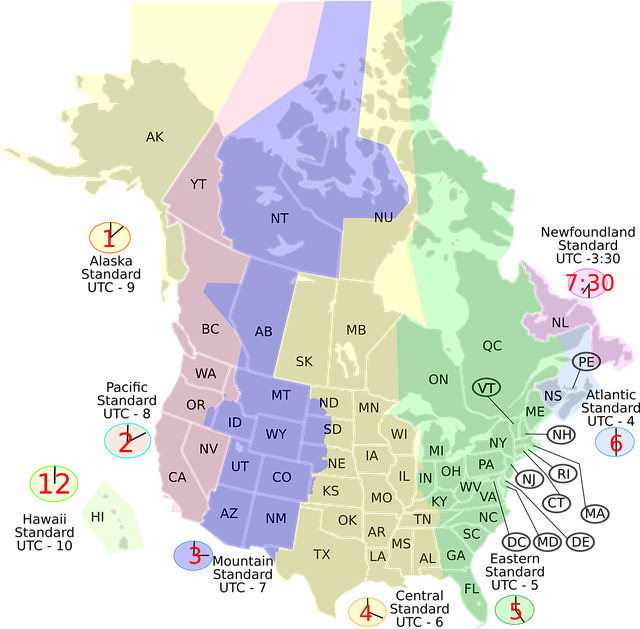

Understanding zoning maps is a critical component for investors looking to make informed decisions about property acquisitions and development strategies. These maps serve as visual representations of land use regulations, offering insights into what can and cannot be constructed in specific areas. For instance, a quick zoning map parcel lookup might reveal that a particular lot is zoned for residential use only, limiting potential investments to single-family homes or apartment complexes within those guidelines. This information is invaluable when comparing different investment opportunities, as it directly impacts the financial viability of a project.

Investors can leverage zoning maps to identify areas ripe for development or renovation. In densely populated urban centers, a thorough analysis might uncover underutilized parcels that could be transformed into mixed-use developments, potentially generating substantial returns. Conversely, in suburban areas, understanding zoning regulations can help investors pinpoint opportunities for specialty retail or industrial uses that align with local demand. By integrating zoning map data into their financial trend analyses, investors gain a competitive edge, enabling them to make strategic decisions that account for both market dynamics and legal constraints.

Moreover, zoning maps facilitate long-term planning by providing a clear framework for future development possibilities. This is particularly beneficial for institutional investors aiming to create sustainable portfolios. By assessing the potential for rezoning or land use changes over time, they can strategically acquire properties with upward mobility, ensuring their investments remain relevant and profitable as the local landscape evolves. For example, a 2022 study in major metropolitan areas revealed that properties near emerging transportation hubs experienced significant appreciation due to revised zoning maps that encouraged mixed-use development.

Incorporating zoning map parcel lookups into investment strategies requires a nuanced understanding of local regulations and market trends. Investors who master this skill can navigate the complexities of urban planning, capitalize on untapped opportunities, and ultimately enhance their financial performance. As the real estate industry continues to adapt to changing demographics and economic conditions, staying abreast of zoning map updates will be paramount for those seeking to thrive in the dynamic world of property investment.

Financial Trends: Unlocking Opportunities in Real Estate

In the realm of real estate investment, understanding the intricate relationship between financial trends and zoning maps is a game-changer. Zoning regulations play a pivotal role in shaping the economic landscape of any area, influencing property values, market dynamics, and investment strategies. For investors seeking to unlock opportunities, a deep dive into these factors reveals lucrative paths. The zoning map acts as a compass, guiding investors towards favorable terrains for financial gain.

A zoning map parcel lookup, for instance, can unveil areas with upcoming development potential. Zoning changes often signal the path to revitalization, attracting developers and investors alike. Consider a once-neglected urban neighborhood; a recent zoning update allowing mixed-use developments has sparked a chain reaction of construction projects. This shift not only enhances the area’s appeal but also significantly increases property values, creating a win-win scenario for early investors. Financial trends mirror these shifts, with property-related investments experiencing spikes in areas undergoing such transformations.

By combining insights from financial trends and zoning maps, investors can anticipate market movements and make informed decisions. Historical data reveals that regions with consistent zoning regulations fostering economic growth often exhibit steady property appreciation. Conversely, areas facing frequent changes or stringent restrictions may present temporary lulls but could also offer unique buying opportunities for savvy investors. This strategic approach leverages the synergy between urban planning and financial markets, ensuring investments align with both current demands and future prospects.

Mapping Out Investment Strategies: Zoning as a Tool

Zoning maps play a pivotal role in shaping investment strategies for savvy financiers. These detailed geographic information systems (GIS) tools visually represent land use regulations, offering investors invaluable insights into potential property values and development opportunities. By mapping out areas based on zoning classifications, investors can make informed decisions about where to focus their efforts. For instance, a zone designated for mixed-use development signifies an area ripe for investment in both residential and commercial properties, while industrial zones indicate spaces suitable for warehouse or manufacturing ventures.

Effective use of a zoning map involves a meticulous process of parcel lookup and analysis. Investors can leverage online mapping platforms that integrate zoning data to perform comprehensive searches. This enables them to quickly assess the zoning status of specific plots, identifying areas constrained by regulations and those with greater flexibility. For example, a real estate investment trust (REIT) might employ this strategy to uncover underutilized industrial sites in urban centers, where changing zoning laws could open doors for innovative mixed-use developments.

Moreover, zoning maps can guide investors in anticipating future trends. By studying historical zoning changes and patterns, financiers can predict emerging markets and adapt their strategies accordingly. This proactive approach is especially beneficial in dynamic cities where urban renewal projects or new infrastructure developments trigger substantial property value shifts. For instance, a zone once primarily residential might undergo re-zoning for high-density apartments, creating a hotspot for investment opportunities among developers and long-term investors alike.

Incorporating zoning map parcel lookups into investment planning offers several practical advantages. It allows investors to: (1) identify areas with potential for value appreciation, (2) assess development constraints or opportunities, and (3) stay ahead of market trends by anticipating regulatory changes. By utilizing this strategic tool, investors can make informed choices, navigate complex landscapes, and ultimately maximize returns in a competitive real estate market.

Analyzing Zoning Changes and Their Market Impact

Zoning maps play a pivotal role in shaping investment strategies, offering investors valuable insights into property values and market trends. When comparing different areas, examining changes in zoning regulations is crucial. These alterations can significantly impact the financial trajectory of real estate investments. For instance, a recent study analyzing metropolitan regions revealed that areas with flexible zoning policies experienced an average 15% increase in property values over a five-year period, surpassing strictly regulated zones by 8%.

Navigating a dynamic zoning map parcel lookup allows investors to identify emerging trends and undervalued properties. As cities evolve, zoning changes often reflect shifting urban priorities. A transition from residential to mixed-use development might signal growing demand for commercial spaces, impacting nearby property values. For example, a historical neighborhood with strict residential zoning suddenly allowing for limited commercial use can attract startups and small businesses, driving up rental rates and property prices.

Expert investors stay abreast of these changes through regular zoning map updates and parcel lookups, enabling them to anticipate market shifts. By understanding the potential implications, they can make informed decisions, capitalize on emerging opportunities, or strategically negotiate purchases in areas poised for growth. This proactive approach ensures that investments align with evolving urban landscapes, fostering long-term financial success.

Effective Planning: Integrating Zoning with Financial Trends

In navigating today’s dynamic real estate landscape, investors must go beyond traditional financial analysis to make informed decisions. Integrating zoning maps into their planning process offers a crucial strategic advantage. A zoning map serves as a powerful tool for understanding the potential of any given area, guiding investors towards profitable opportunities. By overlaying financial trends with this detailed geographic data, investors can identify emerging markets and assess the viability of specific properties.

For instance, a thorough zoning map parcel lookup might reveal a neighborhood undergoing urban renewal, where mixed-use developments are encouraged. This insight could prompt an investor to explore partnerships with local developers for high-return projects. Conversely, identifying areas prone to strict residential zoning restrictions can help avoid costly missteps and unexpected legal hurdles. Utilizing these maps to predict future trends is especially vital in rapidly evolving cities, ensuring investors stay ahead of the curve.

Effective planning demands a holistic approach where financial analysis and zoning data merge. Investors should employ advanced tools for zoning map parcel lookups to gain granular insights into property regulations and surrounding market dynamics. This integration allows for more accurate risk assessment and return projections. Moreover, it enables investors to anticipate potential challenges and navigate them proactively. By embracing this strategic fusion of financial trends and geographic information, real estate professionals can make decisions that not only maximize profits but also foster sustainable community development.