The zoning map is a crucial tool for borrowers and developers, offering detailed land use regulations that influence financing and project success. By understanding these restrictions on building types, density, and uses, users can navigate legal complexities, avoid costly mistakes, and strategically capitalize on development opportunities in a dynamic real estate market. Regular updates to zoning maps reflect changing needs and trends, demanding proactive research for informed decisions. Key insights include:

– Zoning maps guide suitable site selection and property investment strategies.

– Regulations dictate building parameters, shaping neighborhoods and influencing loan terms.

– Staying updated on changes enables capitalizing on emerging trends and opportunities.

– Comprehensive zoning analysis enhances efficiency, mitigates surprises, and secures long-term investment viability.

In the intricate dance of urban planning and development, the zoning map stands as a pivotal tool, shaping the very fabric of communities. As borrowers and developers navigate the complexities of land use, understanding the profound impact of zoning maps is paramount. This article delves into the critical interplay between zoning maps and borrowers’ strategic planning, offering valuable insights to demystify this often-overlooked aspect of real estate. We explore current trends, pinpoint challenges, and present a comprehensive framework to optimize borrowing strategies in harmony with local zoning regulations.

Understanding Zoning Maps: Key to Borrower's Journey

Zoning maps play a pivotal role in shaping borrowers’ journeys, offering crucial insights into land use and development potential. Understanding these detailed geographic information systems (GIS) tools is essential for anyone looking to navigate the complex landscape of property acquisition and planning. A zoning map parcel lookup reveals regulations governing building types, density, and even specific uses, all of which influence a borrower’s strategy and financing options.

For instance, borrowers seeking to develop commercial space in an area zoned for residential use face distinct challenges compared to those in zones designed for business activities. Zoning maps provide transparency, allowing lenders and borrowers to assess potential risks and opportunities early in the process. This knowledge ensures informed decisions regarding property investments and development projects. Accessing these maps through online tools or local government portals has become more accessible, empowering individuals and businesses alike to conduct thorough due diligence.

By integrating zoning map analysis into their planning, borrowers can mitigate surprises and navigate regulatory hurdles efficiently. This proactive approach not only saves time but also enhances the chances of project success. Moreover, understanding zoning regulations enables borrowers to identify areas ripe for development or redevelopment, potentially leading to lucrative opportunities with tailored financing requirements. As the real estate market evolves, staying abreast of zoning changes is vital for borrowers aiming to stay ahead in their financial and development strategies.

Decoding Regulations: How Zoning Affects Property Use

Zoning maps are pivotal tools for borrowers planning property use, shaping their decisions based on detailed regulations. These maps, which visually represent land-use designations, play a critical role in understanding what can be constructed or developed within specific areas. By decoding zoning regulations, borrowers gain crucial insights into potential projects’ feasibility and scope.

For instance, a zoning map parcel lookup reveals that a particular lot is zoned for mixed-use development, allowing residential and commercial structures up to a certain height. This information empowers borrowers to make informed choices about their property investments. They can assess the market demand for mixed-use spaces, plan urban renewal projects, or design custom homes tailored to local regulations. In dense urban areas, zoning maps often dictate building density and set back requirements, influencing floor plans and exterior aesthetics.

Expert analysis suggests that understanding zoning rules is essential for successful borrowing and project execution. Borrowers who engage with local authorities to interpret zoning maps can navigate legal complexities and avoid costly mistakes. Staying updated on zoning changes through regular map lookups ensures compliance and opens doors to innovative possibilities. By embracing the intricacies of zoning, borrowers can contribute to vibrant communities while securing their investment’s long-term viability.

Locating Ideal Areas: Zoning's Role in Site Selection

The zoning map plays a pivotal role in borrowers’ strategic planning process, guiding them towards identifying suitable areas for investment or development. When assessing potential sites, understanding the local zoning regulations is akin to deciphering a complex yet crucial roadmap. This insightful analysis reveals how borrowers can leverage the zoning map parcel lookup to locate ideal locations that align with their objectives.

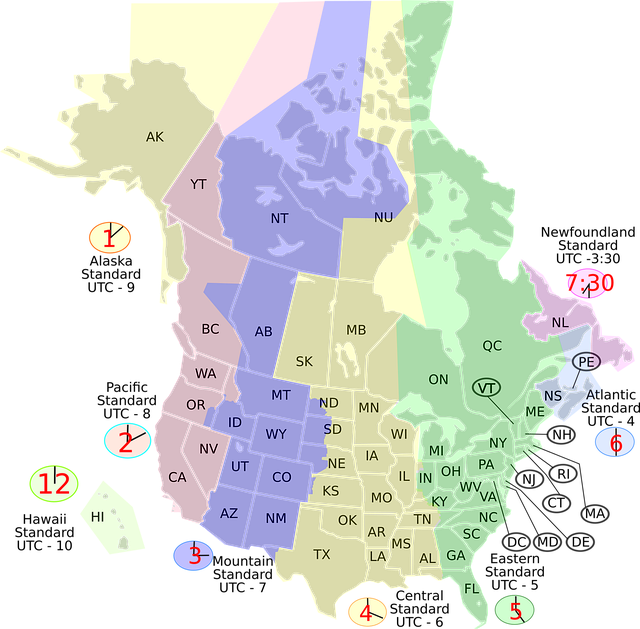

Zoning maps provide detailed information on land-use designations and restrictions across different regions. For instance, commercial zones allow mixed-use developments while residential areas mandate single-family dwellings. By consulting these maps, borrowers gain a strategic edge in site selection. They can avoid missteps by ensuring the desired property types are permitted within their targeted areas. Moreover, zoning regulations often dictate building height, density, and set-back requirements, shaping the physical landscape of neighborhoods.

A practical approach involves integrating zoning map parcel lookup into the initial screening process. This method enables borrowers to filter out non-viable options early on, saving time and resources. For instance, a borrower seeking multi-family housing might use this tool to identify parcels zoned for high-density residential use. The zoning map parcel lookup also facilitates comparisons between different locations, allowing borrowers to weigh factors such as accessibility, infrastructure, and community amenities against the specific zoning designations. By utilizing these insights, borrowers can make informed decisions, ensuring their investments not only comply with local regulations but also thrive within the existing urban fabric.

Impact on Financing: Zoning's Influence on Loan Terms

The zoning map, a critical tool for urban planning, has profound implications for borrowers and lenders alike when it comes to financing and property development. Understanding how zoning regulations influence loan terms is essential for anyone navigating the real estate market. Every parcel of land, as indicated by its unique zoning map parcel lookup, is subject to specific rules that dictate its potential uses, set limits on construction types and densities, and guide infrastructure development. These restrictions can significantly impact a borrower’s ability to secure funding and the overall terms offered by lenders.

For instance, a commercial property zoned for mixed-use may attract easier access to financing due to its versatility, enabling borrowers to envision diverse revenue streams. Conversely, residential areas with strict zoning regulations limiting multi-family dwellings could make it more challenging for borrowers seeking construction loans for large-scale developments. Lenders, aware of these nuances, tailor their loan products and interest rates based on the perceived risk associated with different zoning classifications. A thorough analysis of the zoning map parcel lookup reveals not only the property’s current use but also its potential for future development, which is crucial information for borrowers planning long-term strategies.

Expert advisors recommend that borrowers proactively research zoning maps to anticipate potential loan terms. This proactive approach involves assessing the zone’s permitted uses, height restrictions, parking requirements, and any special considerations. By understanding these factors, borrowers can make informed decisions about project feasibility, choose suitable lenders, and negotiate more effectively. For instance, a borrower planning a sustainable, eco-friendly development in an area with favorable zoning may be able to secure green financing options at competitive rates. Utilizing online tools for zoning map parcel lookups streamlines this process, allowing borrowers to quickly access detailed information that can save time and money.

Future Planning: Adapting to Evolving Zoning Policies

As borrowing and land use patterns evolve, understanding a zoning map has become paramount for borrowers planning future strategies. Zoning regulations, often depicted on these maps, dictate how property can be used, limiting or allowing specific developments. For borrowers, this presents both challenges and opportunities. Those looking to expand existing properties or develop new projects must navigate these rules meticulously, ensuring compliance from the outset.

Future planning necessitates a proactive approach when zoning policies are subject to change. Municipalities regularly update their zoning maps, reflecting shifting societal needs and economic realities. For instance, a recent trend towards mixed-use development has seen many urban areas revising their zoning laws to accommodate vibrant, integrated communities. Borrowers who stay abreast of these changes through regular zoning map parcel lookups can position themselves strategically. By identifying potential future zones, they can make informed decisions about investments or expansions, ensuring their properties align with emerging trends and regulations.

An expert perspective underscores the importance of adaptability. Successful borrowers view a zoning map not as a static document but as a dynamic guide to evolving possibilities. They understand that changes in zoning can significantly impact property values and accessibility. By anticipating these shifts, they can mitigate risks and capitalize on emerging opportunities. For instance, early insights into proposed changes allowing higher-density residential development could encourage investors to acquire properties with the potential for substantial returns once new regulations are implemented.

Practical advice for borrowers includes maintaining an up-to-date understanding of their local zoning map through periodic lookups, consulting with urban planning experts, and staying engaged with community development initiatives. This proactive stance ensures that future plans remain adaptable and aligned with the evolving landscape of zoning policies.