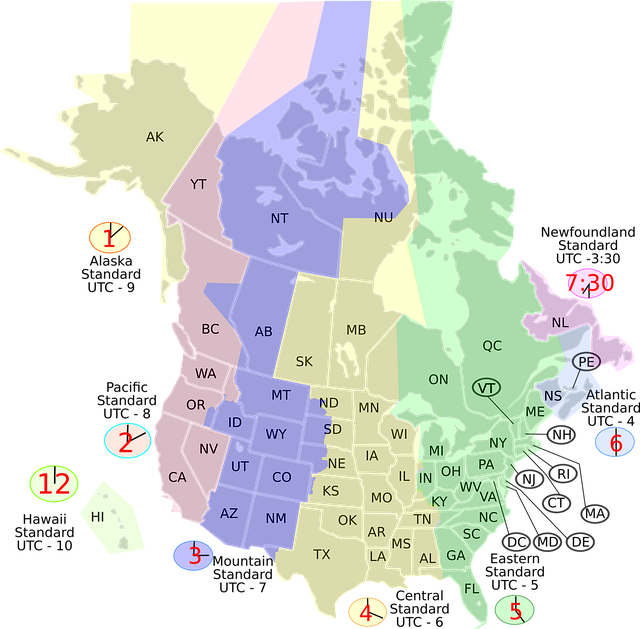

Zoning maps are crucial tools for real estate investors, providing insights into land use regulations, development potential, and market trends. By analyzing these maps, investors can identify high-yield opportunities, anticipate changes, navigate financial implications, and make informed decisions based on data, ultimately ensuring successful and profitable investments.

In the dynamic realm of urban planning and investment, understanding the impact of zoning maps is paramount for navigating financial trends effectively. Zoning maps, serving as the navigational tool for land use, profoundly influence development opportunities and property values. However, deciphering their nuances can be a complex task for investors. This article delves into the intricate relationship between zoning maps and financial strategies, providing insights that enable informed decision-making. By demystifying this crucial aspect, we equip investors with a powerful tool to anticipate market shifts, identify lucrative opportunities, and secure profitable investments in today’s competitive environment.

Understanding Zoning Maps: A Key Financial Tool

Zoning maps are an invaluable tool for investors navigating financial trends, offering a comprehensive view of property use and development potential. Understanding these maps is crucial as they dictate how land can be utilized, influencing investment decisions significantly. A zoning map parcel lookup reveals detailed information about specific plots, including permitted uses, building restrictions, and future development plans. This data allows savvy investors to identify high-yield opportunities and anticipate market shifts.

For instance, a quick zone map lookup might reveal that an area is zoned for mixed-use development, indicating a potential goldmine for investors looking to capitalize on both residential and commercial demands. Conversely, understanding historic zoning changes can signal emerging trends. Areas once designated for light industrial use but later rezoned for residential might experience rising property values due to changing demographics and lifestyle preferences. By analyzing these maps, investors gain a competitive edge, enabling them to make informed decisions based on solid data.

Furthermore, zoning regulations impact not just land value but also financing options. Lenders and insurance providers consider zoning when assessing risk, which can affect interest rates and coverage costs. Investors who grasp the intricacies of zoning maps can better navigate these financial implications, ensuring their investments are both profitable and secure. This strategic approach, grounded in meticulous research, is key to achieving sustainable success in the real estate market.

Analyzing Trends: Mapping Investment Opportunities

Zoning maps play a pivotal role in guiding investors’ strategies by presenting detailed spatial information about land use regulations. When analyzing trends and mapping investment opportunities, these maps offer invaluable insights into potential development sites. For instance, a thorough review of a zoning map parcel lookup can reveal areas suitable for mixed-use projects or identify locations with upcoming rezoning plans. This proactive approach enables investors to anticipate market shifts and capitalize on emerging trends.

Consider a scenario where a real estate investor is exploring expansion opportunities in an urban area. Through a zoning map parcel lookup, they discover a nearby neighborhood experiencing a surge in residential growth but lacking adequate commercial spaces. This data suggests a potential goldmine for developers looking to cater to the expanding population. By understanding the zoning regulations specific to this area—such as permitted building heights and density limits—investors can make informed decisions regarding land acquisition and development strategies, ensuring their projects align with local guidelines.

Furthermore, zoning maps facilitate comparative analysis by providing a standard framework to assess different locations. Investors can compare factors like access to public transportation, proximity to amenities, and environmental considerations across potential sites. This analytical process helps identify areas with high growth potential while mitigating risks associated with incompatible land uses. By combining data from zoning map parcel lookups with financial trends and demographic insights, investors gain a competitive edge in identifying lucrative investment opportunities.

Navigating Regulations: Impact on Property Values

Zoning maps play a pivotal role in guiding investors’ strategies by dictating land use and property development potential. For financial trends to be accurately interpreted, understanding these regulations is paramount, especially when assessing potential returns on real estate investments. Navigating zoning laws is an art, and their impact on property values cannot be overstated. Investors who fail to consider these constraints risk making unprofitable or even illegal acquisitions.

A zoning map parcel lookup reveals the specific zoning designations for each area, providing crucial insights into permitted land use. For instance, commercial zones allow retail and office spaces while residential areas are confined to housing. This distinction significantly influences property values; a piece of land in a thriving commercial zone is likely to fetch a higher price than an adjacent parcel in a residential area. Zoning regulations also dictate building restrictions such as height limits, set-backs, and lot coverage ratios, all of which impact the feasibility and profitability of development projects.

Experts advise investors to thoroughly research zoning maps before committing funds. This involves not only identifying the current zoning classification but also anticipating future changes, which can be predicted through trend analysis and engagement with local planning authorities. By staying ahead of potential rezoning efforts, investors can make informed decisions. For instance, a neighborhood experiencing gentrification may see an influx of new development, prompting existing property owners to capitalize on rising values or face reduced profitability if they fail to adapt. Ultimately, the zoning map is a powerful tool for investors, offering both constraints and opportunities that, when navigated wisely, can lead to substantial financial gains.

Future Projections: How Zones Shape Markets

Zoning maps play a pivotal role in shaping urban landscapes and significantly influence investment strategies for savvy financiers. When investors consider future projections, these detailed plans offer invaluable insights into market trends and potential returns. The zoning map serves as a compass, guiding developers and investors towards lucrative opportunities while steering them clear of areas with restrictive regulations.

By analyzing these maps, investors can identify emerging hotspots and understand the evolving nature of real estate markets. For instance, a recent study revealed that zones designated for mixed-use development in metropolitan areas have consistently shown higher returns over the past decade. This knowledge empowers investors to make informed decisions when purchasing properties or funding construction projects. Moreover, zoning map parcel lookup tools enable efficient site selection by providing specific information on land usage and allowable developments within a given area.

The impact of zoning regulations extends beyond individual investments; it shapes entire neighborhoods. As cities embrace sustainable growth, zoning maps are updated to accommodate eco-friendly practices. Investors who stay abreast of these changes can capitalize on the growing demand for green spaces and energy-efficient buildings. For example, areas implementing strict environmental standards often attract forward-thinking developers, creating a positive feedback loop that enhances property values. Staying aligned with future projections from zoning maps is therefore crucial for investors aiming to navigate markets effectively.