Zoning maps are indispensable tools for investors navigating urban landscapes, offering critical insights into land use, property values, and development potential. By analyzing these maps, investors can identify trends, predict future growth areas, and make strategic decisions aligned with local regulations and community values. This proactive approach minimizes risk, maximizes returns, and enables investors to stay ahead of market shifts in dynamic urban environments.

In the dynamic landscape of urban planning and investment, understanding the impact of zoning maps is paramount. Zoning regulations shape the built environment, influencing property values, development strategies, and financial trends. However, navigating these complexities can be a challenge for investors, often obscured by a web of bureaucratic jargon and local nuances. This article offers a comprehensive guide, demystifying how zoning maps affect investment decisions. We’ll delve into the intricate relationship between zoning policies and market dynamics, providing valuable insights to inform strategic planning and maximize returns in today’s competitive real estate environment.

Understanding Zoning Maps: Tools for Investors

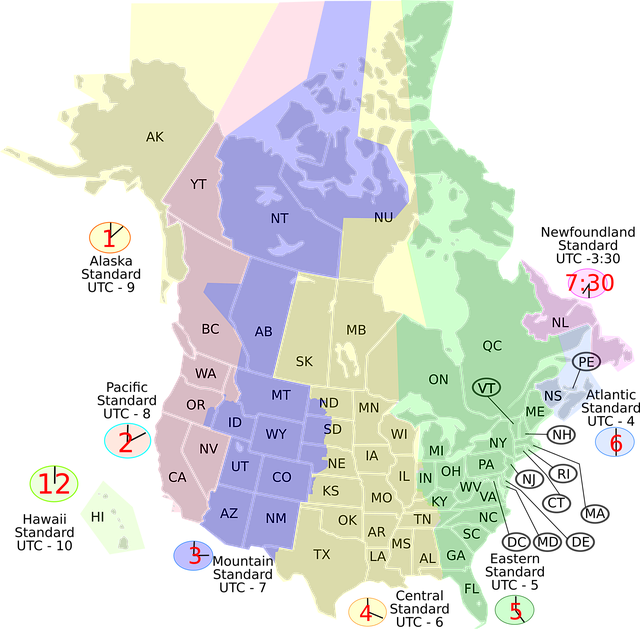

Investors looking to navigate the financial landscape of any city or region must understand the profound impact of zoning maps on their strategic planning. A zoning map is a powerful tool that delineates land uses within a specific area, influencing everything from property values to business operations and residential development. By scrutinizing these maps, investors can uncover crucial insights into an area’s potential, identifying emerging trends and opportunities that may not be apparent at first glance.

For instance, a zoning map parcel lookup might reveal a city’s planned expansion into nearby industrial areas, signaling a possible uptick in commercial real estate investments. Conversely, changes in residential zoning could indicate an influx of new residents, driving up demand for local amenities and services—a goldmine for investors in those sectors. Moreover, understanding the mix of commercial, industrial, and residential zones can help predict future development patterns, allowing savvy investors to stay ahead of the curve.

Expert analysts advocate for a holistic approach when interpreting zoning maps. It’s not just about identifying current land uses but also forecasting how these may evolve over time. This forward-thinking perspective is crucial for making informed investment decisions. By combining data from zoning map parcel lookups with market analysis and demographic trends, investors can make strategic choices that align with an area’s future trajectory rather than its present state. Such a proactive strategy not only minimizes risk but also maximizes returns in today’s dynamic real estate market.

Mapping Financial Trends: Align with Regulations

Zoning maps are an indispensable tool for investors navigating financial trends and opportunities. When aligned with local regulations, these maps offer a clear picture of land use, property development potential, and community plans, enabling informed investment decisions. By understanding the zoning designations and restrictions associated with specific parcels, investors can identify areas conducive to their financial goals. For instance, a zoning map parcel lookup may reveal that a particular neighborhood is zoned for mixed-use development, signaling a prime opportunity for investors looking to capitalize on commercial and residential real estate trends simultaneously.

The mapping of financial trends through zoning maps is particularly crucial in dynamic urban environments where rapid changes in land use policies can significantly impact property values. Regulatory updates often reflect broader urban planning strategies, reflecting the community’s evolving needs and aspirations. Investors who stay abreast of these changes, facilitated by efficient zoning map parcel lookups, gain a competitive edge. They can anticipate shifts in market preferences, identify emerging hot spots, and time their investments accordingly.

For example, a recent surge in demand for sustainable, eco-friendly housing has prompted many cities to rezone areas adjacent to green spaces, encouraging the development of environmentally conscious residential projects. Investors who proactively analyze zoning maps for such trends can secure profitable opportunities by investing early in these emerging markets. This strategic approach not only ensures compliance with local regulations but also fosters investment decisions that resonate with evolving community values.

Impact on Property Values: Market Insights

Zoning maps play a pivotal role in shaping property values and investment strategies, offering valuable insights for market participants. These regulatory tools dictate land use and development patterns, influencing investor decisions and ultimately, real estate trends. When examining property trends, investors should turn their attention to zoning map parcel lookup as a crucial step in their analysis.

The impact of zoning on property values is profound. For instance, a zone designated for high-density residential use may experience higher property valuations due to the potential for multi-family developments. Conversely, industrial zones often attract investments seeking warehouse or manufacturing spaces, driving up asset prices within those areas. Zoning maps provide a snapshot of market opportunities and constraints, enabling investors to make informed choices. Through careful analysis, they can identify undervalued properties in emerging markets or neighborhoods poised for redevelopment, potentially yielding significant returns.

Furthermore, zoning regulations influence future development prospects. Investors should consider the potential for property value appreciation based on upcoming changes to the zoning map. For example, a city’s decision to rezone an area for mixed-use development can spark a cascade of investments, driving up land values and creating a vibrant urban landscape. Staying abreast of such changes through regular zoning map parcel lookups is essential for investors aiming to stay ahead of the curve. This proactive approach ensures they capitalize on emerging trends while mitigating risks associated with changing regulations.

Navigating Investment Strategies: Zones & Opportunities

Investors looking to navigate complex real estate markets must turn to reliable tools that offer a clear view of potential opportunities. One such powerful resource is the zoning map, which plays a pivotal role in shaping investment strategies by delineating land use and development regulations. Understanding this map and its implications can unlock hidden parcel values, making it an indispensable asset for savvy investors.

A zoning map parcel lookup reveals specific zones designated for various purposes, from residential to commercial or industrial uses. These zones are designed to promote orderly growth and community development, but they also present unique challenges and advantages for investors. For instance, a high-density residential zone might attract developers seeking to maximize profit through multi-unit properties, while an emerging tech hub could entice businesses to invest in office spaces, driving up demand and property values. Staying abreast of these trends and understanding the evolving zoning landscape is crucial for making informed investment decisions.

By analyzing historical data on zoning changes alongside market fluctuations, investors can identify areas poised for growth. For example, a recent shift from industrial to mixed-use zoning in an urban center might signal a burgeoning trend towards vertical development, creating opportunities for creative office spaces and modern apartments. Accessing detailed maps that show property lines, existing structures, and zoning designations allows investors to pinpoint prime locations, anticipate market shifts, and make strategic moves. This proactive approach can lead to substantial returns, ensuring that investments remain aligned with both current and future economic trends.

Case Studies: Successful Investments in Zoned Areas

Investors in the real estate market often turn to zoning maps as a crucial tool for strategic decision-making. These detailed maps illustrate the land use designations and regulations for specific areas, offering valuable insights into potential investment opportunities. Successful investors leverage zoning map parcel lookup to identify prime locations that align with their financial goals. For instance, a case study in Manhattan’s Midtown East revealed that investments in zones designated for mixed-use development resulted in substantial returns over a 5-year period, showcasing the impact of informed decisions guided by the zoning map.

A comprehensive analysis of these maps can reveal trends and patterns that influence property values. Areas with zoning regulations promoting high-density residential or commercial uses tend to attract significant investments. Investors should consider the historical performance of such zones to anticipate future growth. For example, a study comparing investment returns in downtown Los Angeles over two decades highlighted the benefits of early investment in areas later rezoned for tech startups and innovative businesses. This success story underscores the importance of staying ahead of zoning changes and understanding their economic implications.

Moreover, zoning maps provide insights into market segmentation, enabling investors to identify niche opportunities. Certain zones may offer tax incentives or special allowances for specific industries, creating favorable conditions for targeted investments. By studying these nuances, investors can make informed choices, as evidenced by the thriving tech hub in Silicon Valley, where strategic zoning decisions have fostered innovation and attracted global investment. Utilizing zoning map parcel lookup to explore these subtleties is an essential practice for navigating complex real estate markets successfully.