Understanding zoning maps is crucial for borrowers seeking property acquisition, as they classify land use regulations, dictating building restrictions and development guidelines. Using parcel lookup tools, borrowers can determine zone designations, aligning intended uses with local regulations. This knowledge aids in project evaluation, secures financing, and tracks urban evolution. Zoning maps significantly impact borrowing potential, shaping landscapes and mitigating risk for lenders. Staying informed about revisions ensures compliance, profitable outcomes, and anticipation of market shifts.

In the dynamic realm of real estate, borrowers and lenders alike grapple with the intricate dance of property utilization and regulatory compliance. Among the tools guiding this process is the zoning map—a vital resource shaping urban landscapes and financial decisions. Understanding its impact on borrowing plans is paramount for navigating today’s complex market efficiently. This article delves into the current insights surrounding zoning maps, elucidating their role in influencing borrower strategies and offering practical guidance for informed decision-making. By exploring these dynamics, we aim to empower stakeholders with valuable insights, fostering more fruitful interactions within the real estate ecosystem.

Understanding Zoning Map Basics for Borrowers

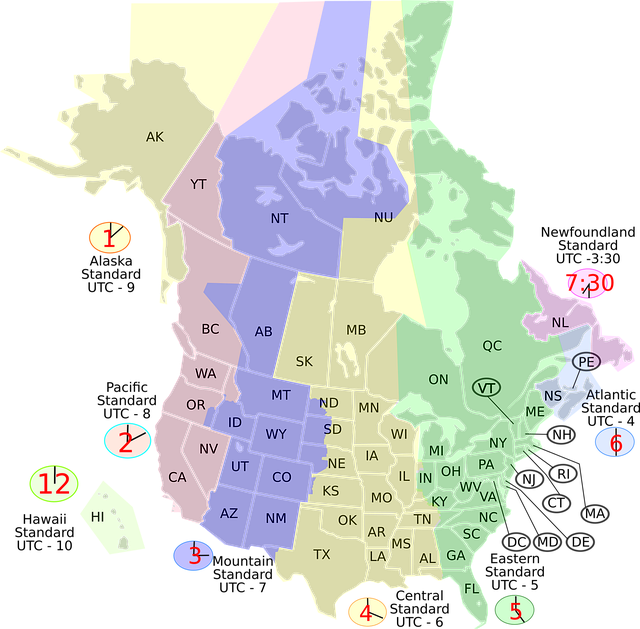

For borrowers looking to navigate the complex landscape of property acquisition, understanding the zoning map is a crucial first step. Zoning maps, comprehensive tools that detail land use regulations, play a pivotal role in shaping real estate decisions. These maps classify each parcel of land into specific zones, dictating permitted uses, building restrictions, and development guidelines. Knowing this information upfront can significantly impact borrowing strategies and project feasibility.

Borrowers can utilize zoning map parcel lookup tools to gain valuable insights into their target properties. By accessing these maps, they identify the zone designation, crucial for aligning intended use with local regulations. For instance, a borrower seeking to develop commercial space would reference the zoning map to ensure the area permits such construction, preventing costly missteps or delays. Moreover, understanding zoning regulations aids in evaluating project potential and securing financing. Lenders often require knowledge of zoning approvals and restrictions to assess risk and determine loan terms.

An expert perspective highlights the dynamic nature of zoning maps. These plans evolve with changing community needs and urban development trends. Borrowers should stay updated on revisions or amendments, as they may open up new opportunities or impose stricter regulations. Regularly checking for changes ensures informed decision-making and a clear understanding of local land use policies. Ultimately, mastering the art of interpreting zoning maps empowers borrowers to navigate the real estate market with confidence, ensuring their plans align with legal boundaries and community guidelines.

Analyzing Land Use Patterns: Zoning Map Insights

Zoning maps play a pivotal role in shaping how we use and develop land, with profound implications for borrowers and lenders alike. Analyzing these maps offers valuable insights into existing land use patterns, enabling informed decisions about property investments and future planning. A zoning map parcel lookup reveals detailed information on specific plots of land, including permitted uses, building restrictions, and density regulations. This data is crucial for understanding the potential of a property and its compatibility with development plans.

For instance, examining a zoning map can highlight areas designated for mixed-use developments, industrial zones, or residential neighborhoods with strict setback requirements. Such insights aid borrowers in evaluating the feasibility of their projects and securing financing. Lenders, too, benefit from this analysis as it mitigates risk by assessing the property’s adherence to local regulations. For instance, a borrower proposing a high-rise apartment complex would need to confirm that the zoning map allows for such a development and that the required infrastructure is accessible.

Moreover, tracking changes in zoning maps over time provides a window into urban evolution. Historical data can reveal successful revitalizations or identify areas in need of redevelopment. Borrowers can leverage this information to capitalize on emerging trends or anticipate future market shifts. By staying abreast of zoning map updates through efficient parcel lookup methods, borrowers and lenders alike can navigate the complexities of land use regulations with greater precision, ensuring their projects remain compliant and profitable.

How Zoning Maps Influence Borrowing Potential

The impact of zoning maps on borrowing potential for prospective property owners is a critical aspect often overlooked in the financial planning process. Zoning regulations, depicted on detailed zoning maps, dictate how land can be used, shaping urban and suburban landscapes. For borrowers, understanding these maps is essential as they directly influence access to financing and overall loan eligibility. Lenders assess zoning information during the underwriting process to mitigate risk, ensuring loans align with permitted land uses.

In many regions, a simple zoning map parcel lookup can reveal crucial details about a property’s potential for development or renovation. For instance, in urban areas, mixed-use zoning allows residential and commercial activities, expanding borrowing opportunities for entrepreneurial individuals. Conversely, agricultural zones may restrict certain types of financing, as lenders prioritize loans supporting farm operations over speculative investments. Data suggests that properties with more flexible zoning regulations have higher loan-to-value ratios, making them more attractive to borrowers.

Borrows can leverage zoning maps proactively by researching local regulations before applying for a loan. This strategy enables informed decision-making and ensures compatibility between financing goals and land use permits. Additionally, consulting with mortgage professionals who specialize in zoning map parcel lookups can offer valuable insights, helping borrowers navigate complex regulatory environments. By integrating zoning considerations into financial planning, individuals can enhance their borrowing potential and secure more favorable loan terms.

Strategizing Property Acquisition Using Zoning Maps

Zoning maps play a pivotal role in shaping borrowers’ strategies for property acquisition, offering valuable insights into land use and development regulations. These detailed maps serve as a comprehensive guide for understanding the potential and limitations of any given parcel of land. For savvy borrowers, utilizing zoning map data can be a game-changer when planning their real estate ventures.

When strategizing property acquisition, borrowers can leverage zoning map parcel lookup to gain critical information about an area’s permitted uses, building restrictions, and future development plans. For instance, a borrower eyeing a residential plot may discover through this lookup that the zone allows for mixed-use developments, opening up opportunities for creative funding models. Conversely, commercial areas might reveal specific requirements for parking spaces, impacting design and cost considerations. Zoning maps also provide insights into density regulations, which can influence borrowing capacity based on project scale.

Expert analysts suggest that borrowers should not only focus on current zoning designations but also stay abreast of proposed changes. Many municipalities regularly update zoning maps to accommodate evolving urban needs. By monitoring these updates, borrowers can anticipate future development opportunities and navigate the market accordingly. For instance, a recent change from industrial to mixed-use zoning in an underserved neighborhood could signal a prime investment window before prices escalate. This proactive approach, powered by zoning map insights, allows borrowers to secure lucrative deals and contribute to vibrant community transformations.