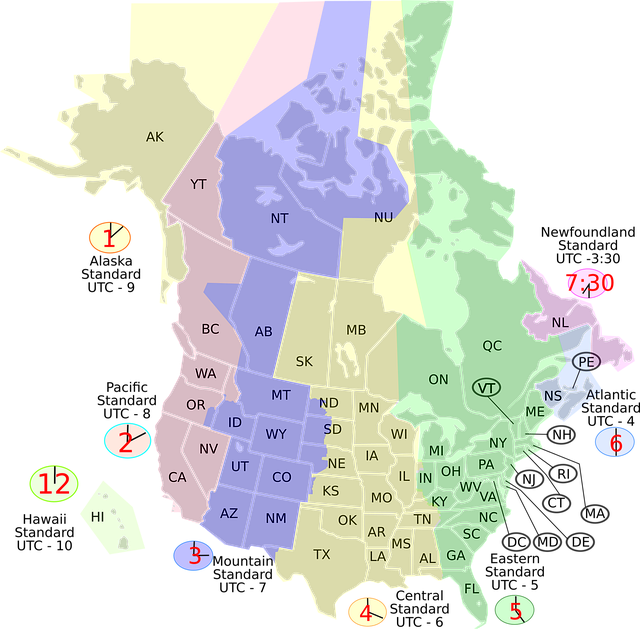

The zoning map is a comprehensive guide for borrowers and lenders, offering insights into land use regulations crucial for property purchases, developments, and loan applications. It details building restrictions, density limits, set-back requirements, and mixed-use permissions. By understanding these maps, borrowers can strategically navigate market demands, avoid legal issues, and maximize investment potential. Lenders use zoning data to assess risk and property values, fostering successful partnerships. Staying updated on revisions ensures projects align with local trends and needs.

Zoning maps play a pivotal role in shaping urban landscapes and guiding development plans. For borrowers navigating the complex landscape of property investments, understanding the intricate relationship between zoning regulations and their projects is paramount. This article delves into the contemporary challenges borrowers face when planning constructions or expansions, highlighting how current insights on zoning maps can serve as a powerful tool for strategic decision-making. By exploring practical applications and recent trends, we offer valuable guidance to ensure informed borrowing strategies aligned with local zoning guidelines.

Understanding Zoning Maps: A Borrower's Perspective

The zoning map is an essential tool for borrowers and lenders alike, offering a comprehensive view of land use and development regulations. From a borrower’s perspective, understanding this map is crucial for planning and securing loans effectively. Zoning maps provide detailed information about specific parcels of land, outlining permitted uses, building restrictions, and future development potential. This knowledge empowers borrowers to make informed decisions when purchasing or developing property.

For instance, a borrower seeking to construct a commercial building would utilize the zoning map to verify if their intended use aligns with local ordinances. Through a simple zoning map parcel lookup, they can confirm the property’s classification, such as whether it allows for mixed-use developments or has specific set-back requirements. This proactive approach not only saves time and effort but also prevents potential legal issues down the line. Moreover, borrowers can assess the development opportunities within their desired areas, considering factors like density, height restrictions, and access to utilities—all vital aspects when evaluating a property’s investment potential.

Expert advice suggests that borrowers should not solely rely on general information about a neighborhood but rather conduct thorough research using online zoning map databases. These tools facilitate detailed analysis by providing up-to-date maps and regulations. By integrating this practice into their planning process, borrowers can ensure they meet all necessary requirements, enhancing the likelihood of successful loan applications and fostering sustainable development practices.

Interpreting Regulations: How Zoning Rules Impact Planning

Zoning maps play a pivotal role in shaping the way borrowers plan their projects, offering crucial insights into land use and development permissions. When navigating the complexities of urban planning, understanding zoning regulations is essential for any borrower looking to utilize property effectively. This involves deciphering detailed rules that dictate what can be constructed, where, and how.

A zoning map parcel lookup becomes a vital tool in this process, allowing borrowers to identify specific zones and their associated restrictions. For instance, a search could reveal an area designated for mixed-use development with specific height and density guidelines. This knowledge is pivotal for borrowers planning commercial or residential projects, as it dictates the scale and nature of proposed structures. Expert advice suggests that borrowers should scrutinize these maps meticulously, considering every detail from building setbacks to permitted land coverage ratios.

By interpreting zoning map data accurately, borrowers can make informed decisions regarding site selection and project scope. This proactive approach ensures compliance from the outset, avoiding costly delays or legal issues down the line. Moreover, understanding zoning regulations can help borrowers identify opportunities for creative solutions—for example, adapting designs to maximize usable space within given constraints. Staying abreast of changing zoning laws is also strategic, as updates often reflect evolving urban planning philosophies and can significantly impact development potential.

Land Use Identification: Unlocking Borrowing Potential

The zoning map serves as a powerful tool for borrowers navigating the complexities of property acquisition and development. By meticulously identifying land use designations, these maps unlock a wealth of borrowing potential, guiding both individual investors and commercial entities in making informed decisions. A nuanced understanding of zoning regulations allows borrowers to assess the feasibility of their projects, from residential construction to mixed-use developments.

Land use identification through zoning map parcel lookup reveals critical insights into property characteristics. For instance, knowledge of specific zones can highlight areas suitable for high-density residential, commercial, or industrial purposes. This information is invaluable for borrowers seeking to maximize returns on investments, as it enables them to target properties aligned with market demands. Consider a case where a borrower discovers a zoning map indicating an emerging tech hub; this insight could steer their decision to acquire office spaces, capitalizing on the area’s growing startup ecosystem.

Moreover, zoning maps provide a framework for assessing borrowing capabilities. Lenders and financial institutions rely on these maps to evaluate property values and associated risks. Borrowers with a solid grasp of zoning regulations can better prepare loan applications, ensuring alignment with local guidelines. This proactive approach enhances their creditworthiness, potentially securing more favorable loan terms. For example, a borrower planning a mixed-use development in a zone permitting both residential and commercial activities can demonstrate to lenders the property’s diverse revenue potential, thereby enhancing the project’s financial viability.

In today’s dynamic real estate landscape, staying abreast of zoning map updates is essential for borrowers. Local governments regularly revise these maps, reflecting changing urban needs and priorities. Regularly checking zoning map parcel lookups allows borrowers to stay informed about new designations, ensuring their projects remain compliant and strategically positioned. By integrating zoning map analysis into their planning process, borrowers can navigate the market with confidence, unlocking opportunities that align with both their financial goals and local land use strategies.

Property Value Assessment: Zoning's Influence on Lender Decisions

The zoning map plays a pivotal role in shaping property values and lending decisions for borrowers. When assessing a potential loan, lenders meticulously scrutinize the specific zoning designation of a parcel of land to gauge its suitability for intended use. This process is crucial as it dictates the type and density of development allowed, thereby influencing both the property’s current and future value. For instance, a residential zone with strict regulations might limit the possibility of commercial usage, which could significantly impact a borrower’s business plan and subsequent investment return.

A comprehensive zoning map parcel lookup becomes an essential tool for borrowers and lenders alike. By utilizing these maps, individuals can gain insights into land use history, current restrictions, and potential future changes. This data-driven approach allows lenders to make informed decisions, assessing both the immediate and long-term risks associated with a property. For example, a borrower looking to develop an industrial site must understand the zoning regulations to ensure compliance from the outset, avoiding costly delays or legal issues.

Moreover, zones with high development potential or areas experiencing changing land uses can present unique opportunities for borrowers. Lenders may view these properties as investments in progress, offering attractive returns. However, they also require careful consideration of market trends and local government initiatives that could impact property values. For instance, the re-zoning of a previously residential area for mixed-use development could lead to substantial increases in nearby property values, benefiting borrowers with well-timed acquisitions.

Legal Considerations: Navigating Zoning Laws for Financing

Zoning maps play a pivotal role in shaping borrowers’ planning strategies, especially when pursuing financing for real estate ventures. These legal tools, detailed on comprehensive zoning maps parcel lookup, dictate land use and development regulations within specific geographic areas. Understanding these laws is not merely an academic exercise; it’s a critical step for lenders and borrowers alike to ensure compliance and mitigate risks.

Navigating zoning regulations requires a deep dive into local government policies. Every municipality creates its own set of rules governing everything from building types and sizes to parking requirements and signage permissions. For instance, a residential zone might restrict commercial activities or permit only single-family dwellings, influencing how borrowers can utilize their properties. The complexity intensifies when considering mixed-use developments, where multiple zoning categories overlap, necessitating careful consideration and expert guidance.

Lenders should advise borrowers to conduct thorough zoning map parcel lookup before finalizing plans. This proactive step ensures that potential financing is aligned with the property’s legal capabilities. Misalignment can lead to costly delays or even legal repercussions. For example, constructing a high-rise apartment building in an area zoned for low-rise residential use would likely face significant hurdles. By anticipating these challenges and aligning funding objectives with zoning realities, borrowers and lenders can forge successful partnerships that enhance property values and foster sustainable development.

Case Studies: Real-World Examples of Zoning Map Effects

The impact of zoning maps on borrowers’ planning strategies has been a subject of growing interest in the real estate sector. Case studies from various regions offer profound insights into how these regulatory tools shape urban landscapes and, consequently, lending practices. For instance, in dense urban centers like Manhattan, New York City’s intricate zoning map dictates building heights, floor-to-area ratios, and permitted uses. This has led to a situation where borrowers seeking construction loans must meticulously navigate the map to ensure their projects comply with regulations, thereby influencing their financial planning and risk assessment.

A study of San Francisco’s zoning maps reveals how specific parcel lookups can significantly impact property values and lending decisions. In areas like the historic Mission District, strict zoning regulations have preserved the character of the neighborhood, but they also limit potential for development. Borrowers looking to refinance or acquire property in these zones must consider not only current market values but also future growth constraints, as indicated by recent changes in the zoning map. This practical insight underscores the importance of staying abreast of local zoning updates during any real estate transaction.

In contrast, suburban areas with more flexible zoning maps offer borrowers diverse opportunities for land use and development. A case in point is a recent trend in Austin, Texas, where comprehensive zoning reforms have encouraged mixed-use developments. Borrowers here can explore creative financing options, such as combining residential and commercial loans, leveraging the dynamic nature of these zones to their advantage. Experts suggest that borrowers should engage in thorough zoning map parcel lookups and consult with professionals who understand local regulations to make informed decisions tailored to their specific circumstances.

By examining real-world examples, it becomes evident that zoning maps are not mere technical documents but powerful tools that influence market dynamics and individual financial strategies. Borrowers must recognize the direct correlation between zoning regulations and property values, lending terms, and potential returns. Staying current with zoning map updates through efficient parcel lookup processes is, therefore, an actionable step toward successful borrowing and investment in today’s evolving urban landscapes.