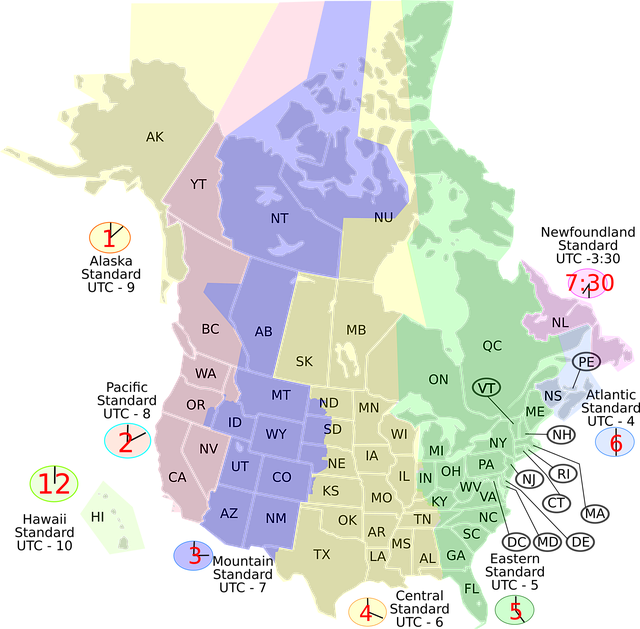

Zoning maps are critical tools for borrowers in real estate planning, providing detailed land use regulations. These maps categorize areas into residential, commercial, industrial, and mixed-use zones, dictating building permissions, loan eligibility, and resale value. By analyzing zoning restrictions, borrowers can assess development potential, facilitate transactions, and plan strategically. Regular updates are essential to stay informed about evolving rules, enabling proactive decision-making and capital allocation in high-growth areas. Zoning maps offer insights into land use trends, helping avoid pitfalls and achieve real estate objectives.

Zoning maps play a pivotal role in shaping urban landscapes and guiding development. For borrowers navigating the complex landscape of real estate investments, understanding the implications of these maps is crucial for successful planning. This article delves into the intricate relationship between zoning maps and borrower strategies, offering insights that can optimize investment decisions. We explore current trends and best practices to help professionals navigate this dynamic field effectively. By the end, readers will grasp how to leverage zoning map data to make informed choices, ensuring their projects remain compliant and profitable.

Understanding Zoning Maps: A Borrower's Guide

When planning a project or purchasing property, borrowers often delve into detailed studies to ensure their investment aligns with local regulations. A crucial tool in this process is the zoning map—a comprehensive guide that outlines specific land uses permitted within a given area. Understanding this map is paramount for borrowers as it dictates how properties can be developed and used, thereby impacting financing decisions significantly.

Zoning maps provide vital information on parcel usage, specifying residential, commercial, industrial, or mixed-use districts. For instance, in urban areas, these maps often differentiate between high-density apartment complexes and low-rise single-family homes zones. Borrowers can leverage these insights to identify potential for development or assess the feasibility of their planned use. A simple zoning map parcel lookup can reveal a property’s classification, access rights, and building restrictions, thus guiding borrowers’ strategies.

Experts emphasize that borrowers should not only consider current zoning designations but also monitor changes in these maps over time. Zoning ordinances evolve to cater to changing community needs and urban dynamics. Regularly checking updates ensures borrowers stay informed about potential regulatory shifts that could impact their projects or investments. This proactive approach allows for better-informed decisions, smoother transactions, and long-term strategic planning.

Mapping Out Property Use: Zoning Regulations Explained

Zoning maps are pivotal tools for borrowers looking to navigate property planning with precision. These detailed geographic databases classify land into zones, dictating how it can be used, developed, and modified. Understanding zoning regulations is crucial when considering any real estate transaction, as it directly impacts potential loan eligibility, construction permits, and even resale value. A comprehensive zoning map parcel lookup reveals not only the permitted uses for a given property but also access to essential services like water, sewer, and electricity.

For instance, a borrower planning a mixed-use development must refer to the zoning map to ensure compliance with local ordinances. In urban areas, commercial zones often coexist with residential neighborhoods, subject to strict regulations on noise levels, operating hours, and signage. A simple zoning map lookup could show that while a property is zoned for mixed use, specific sections have additional restrictions, guiding developers in their design and construction processes. This meticulous planning, facilitated by detailed zoning maps, not only ensures legal compliance but also contributes to sustainable and harmonious community development.

Experts emphasize the importance of thorough research, suggesting borrowers consult local government websites for up-to-date zoning information. Interactive mapping tools, often available through these platforms, allow users to perform precise zone lookups, gaining valuable insights into property capabilities. This proactive approach enables informed decision-making, from securing loans to navigating permitting processes smoothly. By aligning their plans with the existing zoning map, borrowers can mitigate potential legal hurdles and maximize the potential of their investment.

Impact on Loan Options: Zoning and Borrowing Power

The zoning map is a crucial tool for borrowers looking to navigate the complex landscape of real estate financing. It significantly influences loan options and borrowing power by delineating land use regulations and restrictions. Understanding this map can empower borrowers to make informed decisions about property acquisition and development, thereby enhancing their financial prospects.

In many urban areas, a thorough zoning map parcel lookup reveals detailed information on property classifications, building allowances, set-back requirements, and permitted uses. For instance, in densely populated cities, residential zones might restrict certain types of commercial activities, while industrial areas could have stringent environmental regulations. Borrowers aiming to construct multi-family dwellings or mixed-use projects must carefully consider these constraints, as they directly impact financing options and the overall project feasibility. According to recent studies, properties in areas with flexible zoning regulations often attract a broader range of lenders due to their higher investment potential.

Expert lenders and real estate advisors advocate for a deep dive into the specific zoning map details pertinent to the borrower’s target property. This strategic approach allows for a precise evaluation of borrowing capabilities, avoiding potential pitfalls associated with non-conforming uses or limited development rights. By factoring in these nuances, borrowers can secure more favorable loan terms, access innovative financing models, and ultimately achieve their real estate objectives. For example, a borrower seeking to rehabilitate an older building might discover that specific zoning requirements affect the types of loans they qualify for, prompting them to explore rehabilitation-focused funding programs.

Navigating Restrictions: Zoning Map for Smart Decisions

Navigating Restrictions: Utilizing the Zoning Map for Smart Decisions

When borrowers plan their real estate ventures, understanding the local zoning map is paramount. This comprehensive guide offers insights into how this essential tool can shape borrowing decisions and strategic land use. The zoning map serves as a blueprint, delineating permitted uses, building dimensions, and set-back requirements for each parcel of land. By scrutinizing these restrictions, borrowers gain valuable knowledge about potential development opportunities and constraints.

For instance, a borrower eyeing urban redevelopment might discover that a particular area allows mixed-use developments, presenting an attractive investment prospect. Conversely, in suburban areas, zoning maps often dictate single-family residential usage, influencing borrowing options for multi-family projects. The zoning map parcel lookup becomes a critical step in the initial screening process, enabling borrowers to narrow down desirable locations and avoid time-consuming applications for variances or special permissions.

Moreover, analyzing zoning regulations can mitigate future risks. Some maps may reveal upcoming changes, such as reclassification of a district for higher density. Borrowers proactive in these scenarios can capitalize on opportunities or plan accordingly to adapt their strategies. Data from urban planning departments and local government websites offer valuable insights into zoning trends, ensuring borrowers make informed decisions.

To maximize the benefits of the zoning map, borrowers should engage with professionals who specialize in land use. These experts can provide practical advice tailored to specific parcels, guiding borrowers through the intricacies of regulations and their implications. By combining this expert perspective with thorough zoning map analysis, borrowers can navigate restrictions effectively, making sound borrowing decisions that align with local frameworks.

Future Planning: How Zoning Maps Guide Investments

Zoning maps play a pivotal role in shaping future urban landscapes and guiding borrower investments with considerable precision. These detailed geographic tools categorize land use, building density, and other restrictions, serving as a road map for development projects and real estate decisions. By scrutinizing zoning map parcel lookup data, lenders, investors, and developers gain crucial insights into property potential, enabling informed choices about where and how to allocate capital.

Consider the example of a growing tech hub city. Zoning maps reveal clusters of commercial spaces zoned for mixed-use development, alongside residential areas with strict height limitations. This data empowers borrowers to identify emerging hotspots, anticipate future demand, and strategically invest in properties that align with evolving urban trends. For instance, a borrower might discover an undervalued parcel near a proposed transit expansion, indicating high growth potential for commercial or mixed-use developments.

However, zoning maps are not static; they evolve alongside societal changes and urban planning initiatives. Borrowers who stay abreast of these updates through regular zoning map parcel lookup analyses gain a significant advantage. Changes in zoning regulations can unlock new investment opportunities or present challenges, necessitating adaptability in borrowing strategies. Understanding the dynamic nature of these maps ensures borrowers remain agile and positioned to capitalize on emerging trends while mitigating risks associated with unforeseen restrictions.