Zoning maps are crucial tools for investors, offering insights into land use permissions, building restrictions, and property boundaries. Analyzing these maps alongside land records provides comprehensive data, impacting investment strategies through regulatory changes and market trends. Specialized platforms tracking zoning updates enable informed decision-making, navigating regulatory hurdles, and capitalizing on emerging opportunities in dynamic markets. These tools are vital for identifying diverse neighborhood trends and securing advantageous positions, as demonstrated by successful investor cases.

In the dynamic landscape of urban development, investors play a pivotal role in shaping metropolitan areas. Understanding the intricate relationship between financial trends and zoning maps is essential for navigating this complex game. Zoning maps, as tools that dictate land use and building regulations, significantly influence investment strategies. This article delves into how these maps can either open doors to lucrative opportunities or present formidable challenges for investors. By exploring the interplay between financial analysis and zoning ordinances, we aim to equip professionals with valuable insights, enabling them to make informed decisions in today’s competitive market.

Understanding Zoning Map: Financial Trends Insight

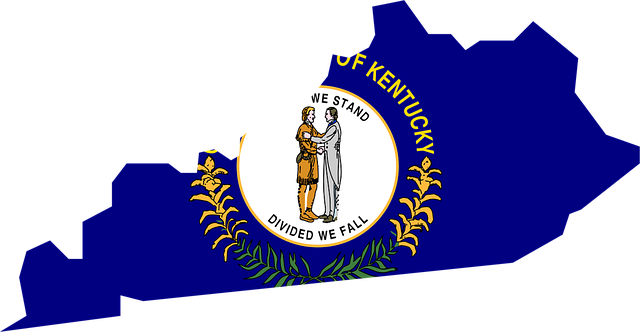

The zoning map is an indispensable tool for investors navigating financial trends, offering a granular view of an area’s development potential. By understanding the nuances of this map, investors can uncover significant insights that drive their decision-making processes. Each zone categorizes land use based on regulations pertaining to building types and density, providing a clear picture of where investments are likely to flourish or face challenges. For instance, a zoning map might designate specific areas for residential, commercial, or industrial purposes, with corresponding restrictions on floor space ratios and permitted uses.

Integrating zoning map parcel lookup during analysis allows investors to delve deeper into property specifics. This process involves cross-referencing the map with detailed land records, enabling them to assess factors like property boundaries, ownership history, and existing infrastructure nearby. Such comprehensive data is vital for evaluating investment opportunities accurately. For example, a commercial investor might discover that a desired parcel has access to major transportation routes and utilities, enhancing its appeal and potential return on investment (ROI).

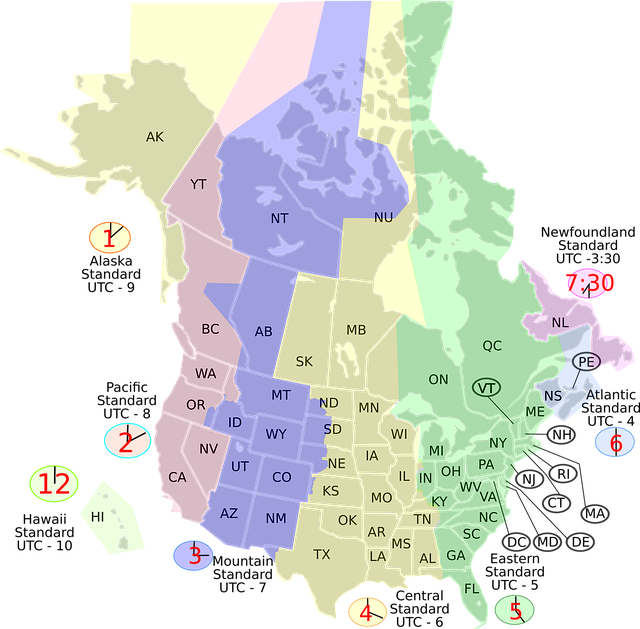

Moreover, changes in zoning regulations over time can significantly impact financial trends. Investors must stay abreast of these alterations to anticipate market shifts. Zoning map updates often reflect urban planning goals, demographic changes, or economic strategies, influencing property values and rental rates. For instance, a recent change from industrial to mixed-use zoning might spark interest from developers aiming to capitalize on the growing demand for trendy, walkable neighborhoods. Understanding such transformations equips investors with the knowledge to time their entries or exits strategically.

To leverage these insights effectively, investors should employ specialized tools that integrate zoning map data with market analysis. These platforms allow for dynamic tracking of trends and changes, enabling proactive decision-making. Regularly updating one’s understanding through industry publications, government reports, and local expert insights also fosters informed investment strategies. Ultimately, mastering the art of interpreting zoning maps is a game-changer in navigating financial landscapes, ensuring investors stay ahead of the curve and maximize their returns.

Analyzing Regulations: Impact on Investor Strategies

Zoning maps play a pivotal role in shaping investor strategies, particularly when navigating financial trends. These regulatory tools dictate land use and development permissions, profoundly influencing property values and investment opportunities. By meticulously analyzing zoning map parcel lookups, investors can uncover hidden gems and avoid potential pitfalls. For instance, a quick check of the zoning map may reveal a pending change allowing mixed-use development in an area once strictly residential, significantly enhancing investment prospects.

Regulatory scrutiny extends beyond current designations. Investors astutely monitor proposed amendments to zoning maps, anticipating future market shifts. Consider a bustling city center where officials are considering rezone areas to prioritize mixed-use high-density developments. Early insight into such changes allows forward-thinking investors to capitalize on emerging trends. This proactive approach leverages the dynamic interplay between zoning maps and financial markets, enabling informed decision-making.

Practical implementation demands a comprehensive understanding of local regulations. Investors should employ advanced tools for zoning map parcel lookups, ensuring they grasp property boundaries, permitted uses, and any restrictions. Such due diligence is crucial for mitigating risks associated with unexpected regulatory hurdles. By integrating zoning analysis into their investment strategies, professionals can navigate complex landscapes, foster sustainable growth, and ultimately secure lucrative opportunities in an ever-evolving market.

Navigating Restrictions: Optimal Investments Unveiled

For investors navigating complex urban landscapes, understanding a zoning map is akin to deciphering a crucial roadmap. This tool, often overlooked yet immensely powerful, dictates the trajectory of real estate ventures by delineating land use and development regulations. When planning strategic investments, a deep dive into zoning maps reveals opportunities that might otherwise remain hidden beneath the surface.

Imagine a vibrant city where each neighborhood possesses its unique character—from dense commercial hubs to tranquil residential areas. Zoning maps visually represent these distinctions, allowing investors to align their choices with local dynamics. For instance, in areas designated for mixed-use development, investors can anticipate dynamic growth by combining retail, office, and residential spaces. Conversely, zoning map parcel lookup may unveil underutilized industrial sites ripe for conversion into modern co-working spaces, catering to the remote workforce trend.

Navigating these restrictions requires a keen eye for detail and a forward-thinking mindset. Investors who stay abreast of zoning changes can position themselves advantageously. Consider a case study where a proactive investor identified a changing zoning map signaling an upcoming shift from residential to mixed-use development in a previously quiet suburb. By securing land at an early stage, they reaped substantial returns as the area transformed into a bustling hub of restaurants and boutique shops. This example underscores the transformative power of zoning maps in guiding investors toward lucrative opportunities.

To harness this knowledge effectively, investors should employ specialized tools for zoning map parcel lookup, ensuring they grasp local regulations and potential future changes. By embracing this strategic approach, they can make informed decisions, stay ahead of market trends, and unlock investments that align perfectly with the evolving urban landscape.